The fact is that legal documentation is one of the main challenges in the process of loan or leasing origination.

The reason is very simple, not only are there many types of contracts, clauses, restrictions and constraints but also, each organization has its own legal texts and especially, its own rules of application.

The challenge of automating the legal documentation of a loan origination process is both a productivity and a financial institution’s profitability challenge as it greatly reduces the financing cycle and the number of loan errors. In addition, automation allows the organization to truly take a digital turn by eliminating paper from the process.

Indeed, the legal documentation of a loan can take weeks to produce but also, the contractual errors and the failures to deadlines create each year loss of millions for the financial institutions

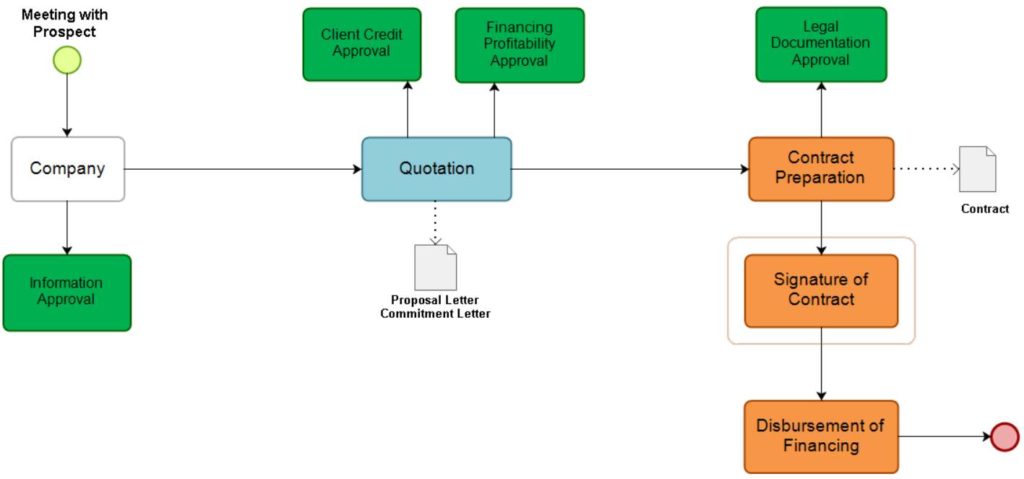

In general terms, the financing process is as follows:

We discussed customer database management (CRM) and listing processes in the two previous posts. The documentation process is the last process that involves the sales force (and administrative departments) of the organization. Generally, the representative begins the financing process, an assistant finalizes the details and one or more teams of administrators are responsible for validating the whole and issuing the check. A workflow must exist in this process to allow the different entities involved in the process to exchange without using either email or paper.

Legal Documentation Generation

The challenge is to convert a bid into a draft contract that would allow the various users of the organization (representatives, assistants, administrators, etc.) to generate all the necessary documentation to conclude a financing transaction.

It is understandable that automating the documentation generation in the financing process is complex. This is especially true in Quebec where the language and the law are different from the rest of the country. The application must actually be able to generate the legal documentation in either French or English and the legal aspect of the transaction must consider that the client does not necessarily reside in Quebec; the documentation must reflect this fact.

What is needed to automate the generation of documentation?

Understandably, a great deal of information and many steps are required in this mechanism:

- Detailed financial structure

- Terms of payment and refunds

- Description of the financed properties

- Description of the Supplier (s)

- Description of beneficiaries, guarantors and guarantees

- Actions to be completed after disbursement

- Dynamic clauses specific to the contract

- Documentation approval workflow

- Production, signature and disbursement for the contract

- Documentation Back up in an ECM (Enterprise Content Management)

- Follow-up actions after disbursement

Detailed financial structure

To generate a letter of offer to the client, the representative used a quote generation module that allows him to enter the main elements of the transaction as well as various financial scenarios to propose to his client. This module should allow representatives to quickly generate quotes. Conversely, the documentation module must be picky and take into account all the details. Of course, we recover all the quotation data and we add all that is missing, and we refine some data. For example, the exchange rate will be set, the TRUE amount of the invoice will be entered, etc.

Terms of payment and refunds

The details of the financing structure make it possible to calculate the real monthly payments according to a set of parameters including the balloon or the number of payments per year … Is the transaction part of a program? Will the customer make regular payments throughout this time?

Description of the financed properties

It is important to properly describe the goods financed because within the contract, if there is a glitch, we must be able to properly identify the goods financed. Even more importantly, when several financings are made for the same client, one must be able to calculate our “exposure”. This calculation is sometimes tedious when the good data are hard to find.

Description of the stakeholders

At this stage, the data is rather static. Admittedly, it is important to write the correct addresses on the legal documents but since these data are recovered from the CRM, it will be the rigor of the validations which will be most important.

Actions to be completed after disbursement & Follow-up actions after disbursement

The goals of automating this process are to speed it up and minimize errors. It must therefore be flexible and that, for example, not to hold the original invoice is not a brake. At the same time, if the rules of the organization indicate that the original invoice is required, a mechanism is needed to ensure that nothing is missing.

The core of the process

The core of the process is unquestionably the generation of the contract itself. For the user, this is reduced to clicking a button. For the application, it is the recovery of all data entered, the analysis of these and especially the application of the organization’s business rules. This is without a doubt the functionality in which we find the Business Intelligence of the organization. The type of contract to be used, the necessary documents and clauses will be automatically determined, and the legal documentation will be generated in the client’s language and it can be inserted into an email for reading and potentially also, for signature. Errors in the generation of legal documentation can be really problematic, hence the importance of managing all cases well. For example, if an approval is missing, we will not want to stop moving ahead in the process, but the legal documents produced must be marked “draft”.

Documentation Back up in an ECM (Enterprise Content Management)

The company that has invested in the automation of the documentation process of loans and leases will certainly want to one day complete its turn of the wheel by the digitization of all recovered and generated documentation. At first glance, one could think that it is a matter of selecting and implementing an ECM like FileNet or SharePoint but in reality, it is not the case. In fact, if users are asked to save all the documentation of a financing transaction in an ECM, in spite of a defined data structure, it is certain that after a few hundred or thousands of saved documents, the “bank” of documents will look more like a spaghetti than an office tower. It is therefore important to install an interface responsible for backing up and retrieving documents in the ECM to preserve their integrity. It is this interface that will be responsible for respecting the established data structure and that will know when it is time to retrieve a client’s financial statements, where they are and which ones are the most recent, for example.

Launching your Automated Documentation Generation Project

There are several reasons that can motivate an organization to automate its documentation generation process. It does not matter whether it is the volume, growth, number of errors, governance or strategic direction of the parent company, the important thing is to choose the right tools and the right resources. Without a doubt, it is a project where communication will prevail because several departments of the organization will be involved; Legal, IT and Sales. I believe it is important to use business tools that meet the needs of the organization, but do not try to adapt them to your own way of doing things. It’d be better to invest in “proprietary code” that better meets your specific needs by enabling easy communications with your different business systems.

Leave a Reply